Syllabus Overview

- Applied Knowledge

- Applied Skills

- Strategic Professional

General Details

ACCA can be pursued right after school (two A Levels and three GCSEs or equivalent in five separate subjects, including English and Mathematics) or as an under-graduate as well. Students from commerce stream should pass in 5 subjects including English and Mathematics / Accounts with a Mark of at least 65% in 2 Subjects and over 50% for others. It is ideally for those who are aspiring for or already in finance and accounting career. For graduates, up to 9 exemptions may be claimed at the Fundamentals level of ACCA depending on the degree and university.

Qualification requires passing up to 13 exams and completing a term of 36 months of job experience in a relevant firm.

Various entry level to ACCA

| Course | Exemptions | Remaining |

| CIMA | 9 Papers | 4 Papers |

| ICAI | 9 Papers | 4 Papers |

| CPA | 8 Papers | 5 Papers |

| CMA – GRADUATES TO DECEMBER 31ST 2015 | 7 Papers | 6 Papers |

| BACHELOR OF COMMERCE | 4 Papers | 9 Papers |

| CMA – GRADUATES FROM 01ST JAN 2016 | 3 Papers | 10 Papers |

| CIA | 3 Papers | 10 Papers |

Foundation in Accountancy

A candidate can register in FIA without any minimum entry requirements and on completion of FAB, FMA and FFA will be transferred to ACCA and will get exemption from first three papers of ACCA.

To enroll in the course, please contact the relevant staff at +971544525495 and a payment link will be sent to your email address.

After the payment is completed, your access will be active within 4 to 7 days

| Paper | Recorded session | One to one live session | Important Features | Learning topics |

| Applied Skills Level | ||||

| Performance Management (PM) | 40 to 60 Hours

(Classes recorded by expert UK faculties) |

6 Hours of one-to-one online live doubt clearing session.

(Split into 6 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Taxation (TX) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Financial Reporting (FR) | 40 to 60 Hours

(Classes recorded by expert UK faculties) |

6 Hours of one-to-one online live doubt clearing session.

(Split into 6 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Audit and Assurance (AA) | 40 to 60 Hours

(Classes recorded by expert UK faculties) |

6 Hours of one-to-one online live doubt clearing session.

(Split into 6 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Financial Management (FM)

|

40 to 60 Hours

(Classes recorded by expert UK faculties) |

6 Hours of one-to-one online live doubt clearing session.

(Split into 6 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Strategic Professional Level | ||||

| Strategic Business Reporting (SBR) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Strategic Business Leader (SBL) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Advanced Financial Management (AFM) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Advanced Taxation (ATX) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities 9. Model answers to cross-check your answer. |

Download learning topics.

|

| Advanced Performance Management (APM) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

| Advanced Audit & Assurance (AAA) | 40 to 80 Hours

(Classes recorded by expert UK faculties) |

8 Hours of one-to-one online live doubt clearing session.

(Split into 8 sessions of 1 Hour each)

Students can interact directly with Bradford faculty to clarify any questions. |

1. Assessments and 1 Self Mock test in the platform.

2. Award-winning Virtual learning environment. 3. CBE Practice Platform for question practice. 4. Further practice questions (Printable). 5. BPP or Kaplan soft copy study material and revision kit. 6. Exam Debrief and Revision videos 7. Complete syllabus coverage 8. Topic specific practice activities |

Download learning topics.

|

The complete exam structure is as follows,

Applied Knowledge Level | MCQ, 2hr, 50 questions

F1-Business and Technology (BT),

F2-Management Accounting (MA),

F3-Financial Accounting (FA)

Applied Skills Level | 2hr, Question testlets

F4-Corporate and Business Law (LW*)

Applied Skills Level | 3hr, Question testlets

F5-Performance Management (PM)

F6-Taxation (TX)

F7-Financial Reporting (FR)

F8-Audit and Assurance (AA)

F9-Financial Management (FM)

Professional Ethics Module

The ACCA Professional Module comprises of nine self-study units and tests which assess your ethical behaviour.

The ACCA say the average user takes around 3.5 hours to complete the module, but you can take as much or little time as you need.

To complete the module, you’ll record your learnings in a Learning Statement

Essentials | Question testlets

Strategic Business Leader (SBL) – 4Hr

Strategic Business Reporting (SBR) – 3hr & 15mnts

Optionals | 3hrs & 15mnts, Question testlets

Advanced Financial Management (AFM)

Advanced Performance Management (APM)

Advanced Taxation (ATX*)

Advanced Audit and Assurance (AAA*)

- Gold Approved Learning Partner of ACCA

- We have achieved 98% result in the foundation level and above global pass percentage for other papers.

- Self-paced learning enabling the students to learn and complete the portions at their own pace.

- Self-paced method avoids any last-minute cancellation of the class by the institutes.

- Our One-to-one doubt clearing session is very effective as students can freely interact with the trainer.

- Our One-to-one trainers for Professional level are faculties who have experience in taking SBR, SBL and other papers for

at least past 10 plus years.

- Classes recorded by expert ACCA qualified faculties in the UK.

- Our One-to-one doubt clearing session is very effective as students can freely interact with the trainer.

- We provide the opportunity to students to practice in the actual CBE platform.

- Model answers to cross-check the answers written by students in the CBE platform.

- Revision videos

- Bradford offers complete guidance through registration with ACCA, exam registration and obtaining the certification.

Bradford Learning Global is the Gold-Approved Learning Partner of ACCA in the UAE

Click to view the Gold-Approved Learning Partner certificate

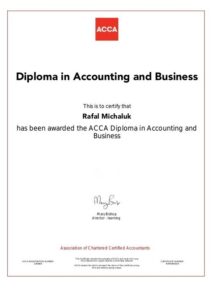

The student will receive a Diploma in Accounting and Business from ACCA upon successful completion of the knowledge level.

The Bradford Learning Global team works with a wide range of companies and Audit firms.

Bradford Learning Global aids students in the UAE and KSA who pass the knowledge level in getting internships with companies.

ACCA approved study material & revision kit (BPP / Kaplan)

Exams are available in March, June, September and December.

Exam Registration:

Get to know your exemptions by visiting the ACCA exemptions calculator.

Register as an ACCA student by visiting this page.

Enter for the exams after remitting Conditional Exemption fee and exam fees.

Exam Result:

CBE (Computer Based Exam)

Instant results are provided, so if you sit an on-demand CBE you will know immediately if you have passed.

Session-based exams results are normally published 5 weeks after the exam session has finished.

You can find a full list of our important exam dates and deadlines by following the link.

The passing marks for ACCA are 50% for all exams

How do I apply to be an ACCA student?

You can register online to become an ACCA student at any time of the year.

Applying online allows you to upload all your supporting documents. This means your ACCA application will be processed much quicker and you will know at which level you can start your studies shortly after submitting your application.

Ready to begin your application? Apply to become a student.

To avoid delays in the application process please include all supporting documents at time of registration.

What are the entry requirements for the ACCA Qualification?

The minimum entry requirements for the ACCA Qualification are:

Two A-Levels and three GCSEs (or their equivalent). These need to be in five separate subjects including English and maths.

To check if your qualifications meet our minimum entry requirements, please check the minimum entrance requirements database.

What are the entry requirements for Foundation-level?

There are no minimum entry requirements – you can start at any level. However, we strongly recommend you start at the ACCA Diploma in Financial and Management Accounting (RQF Level 2) if you have no formal qualifications, especially if it has been a while since you completed any studies.

This is because students who start at the ACCA Diploma in Financial and Management Accounting (RQF Level 2) and work their way through the Foundation level-qualifications perform better in the higher level exams.

What documents do I need to register as a student?

You will need to supply the following:

Documents supporting your educational achievements

Your educational documents must:

name your qualification(s)

be signed and stamped by the awarding institution/body (including logo)

include transcripts/marksheets detailing the subjects/module codes and the marks achieved

show date of completion for full academic award or confirmation of years successfully completed

your award certificate(s) and/or an official letter confirming completion

If you have changed your name after obtaining your qualification documentation please submit a copy of an official document for this change.

Proof of identity

We can accept the following as proof of identity

copy of birth certificate

passport

National ID Card or driving licence

Translations of your documents

If you are providing your documents in a language other than English, you’ll need to provide an official translation as well as a copy of the documents in their original language.

Official translations must be performed and stamped by a licensed translator.

How to send us your documents

You can upload copies of all your documents during the online application process.

Please note that in order to fully complete your application online you will be required to pay your registration fee by credit or debit card.

Ready to apply? Start your application today.

Click here for more FAQs

About the instructor

Bradford Learning Global has a group of competent ACCA instructors that are both subject matter experts and industry veterans. We work with tutors who have created both National and Global rank holders.